Just in Time or Just in Case?

Do we need to rethink how we supply the things we buy? Professor Adrian Palmer discusses the reliability of Just in Time and Just in Case supply chains.

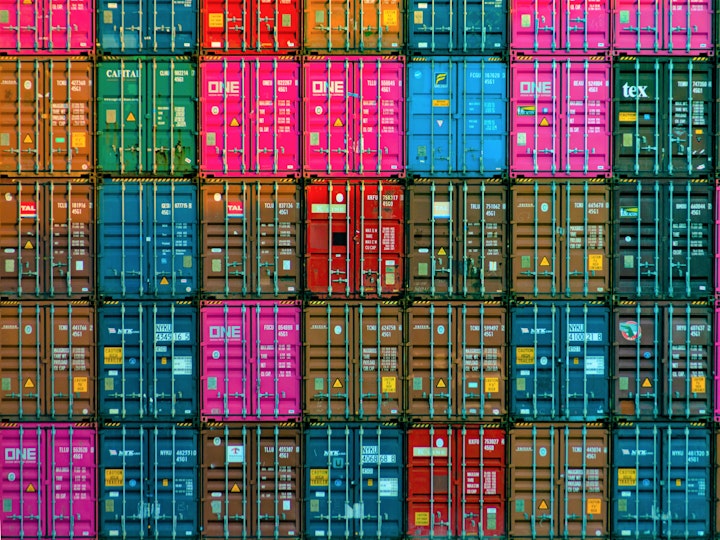

Hardly a day passes without news of supply problems affecting the things that businesses and consumers can buy: in developed western economies, pictures of empty supermarket shelves and queues at petrol stations make headlines as shoppers are warned not to panic buy. A lack of lorry drivers, the shift to online shopping and subsequent demand for warehouse space have contributed to the current issues in our supply chains.

But are our current supply chain problems a temporary blip caused by imbalances which will soon be corrected by market forces? Or is there more fundamental change taking place which will have longer-term effects?

The pandemic has challenged ‘Just-in-Time’ (JIT) distribution channels. These became popular from the 1980s, based on the idea that capital tied up in stock was wasteful, and smarter distribution systems mean companies only receive goods as they need them for the production process, which would save the financing and warehousing costs of keeping large stocks. Many have been quick to write off JIT globalised chains, claiming they are not resilient, and point to ‘Just-in-Case’ (JIC) as a more resilient approach. This has sometimes conveniently been conflated with issues of climate change and the need to reduce long-distance transport of goods.

Yet JIT supply chains have become part and parcel of the modern world – so much so that Toyota have had to temporarily cut production because their JIT supply of autochips have not arrived in time.

In reality, there is no dichotomy between JIT and JIC supply chains. Even the most efficient JIT supply chain recognises differences in categories of products - some are more critical than others and need additional stocks for resilience. JIT is about trying to understand and predict uncertainty likely to affect a supply chain. Unfortunately, there was no precedent for the pandemic in which multiple sources of uncertainty interacted and created catastrophic failings in critical parts of supply chains.

But does this failure challenge the principle of JIT supply chains?

The pandemic has provided more data to calibrate models of risk and uncertainty. But many more serious potential risks remain to be understood, for example what would be the effects of political and economic isolation of China? How far should supply chain managers go to reduce dependence on China, balancing a greater cost of sourcing from elsewhere, against the currently remote possibility of China being cut off from the rest of the world?

It is likely that supply chains will become more resilient by holding additional stocks, but the principal of assessing risks and minimising stockholdings will remain true. Interestingly, in the short term, as companies seek to build up stocks to improve their resilience, one consequence will be further imbalance between supply and demand. So at a time when consumers are using their accumulated savings to buy more goods, shortages may be exacerbated by companies building up reserve stocks.

We have taken supply chains for granted for many years, and many of us only recognise them when they go wrong. Gaps in supermarkets’ vegetable displays may be a routine sight in some countries with less developed distribution channels. In most European countries, it is a tribute to the efficiency and effectiveness of supply chains that we only talk about them when our favourite products are not available.