Finance Research Team Wins Best Paper Award at International Conference

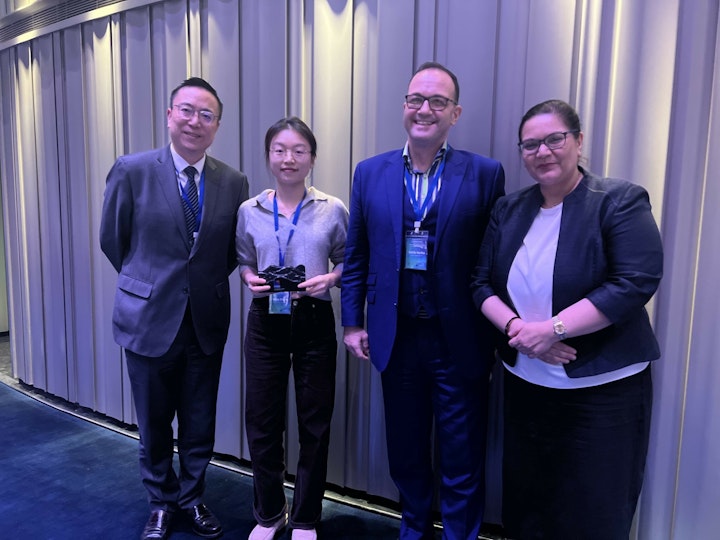

ICMA Centre Professors Professor Radu S. Tunaru and Professor Emese Lazar, jointly with Ning Zhang, have won the Best Research Paper Award at the International Finance and Banking Society (IFABS) Conference in Shanghai, China, in December 2024.

Their paper, “Measuring Model Risk for Market Risk Measures”, introduces a new framework for capturing model risk in two widely used financial tools — Value-at-Risk (VaR) and Expected Shortfall (ES). These measures help banks and regulators estimate potential losses during turbulent markets, but their accuracy depends heavily on the models behind them.

The team’s research highlights how model risk arises from both parameter estimation and model design, and why measuring it is vital for making risk estimates more reliable. Their approach addresses gaps in current methods, particularly for Expected Shortfall, and offers banks a clearer way to compare and manage risks.

By quantifying model risk in monetary terms, the study gives financial institutions better tools to predict losses, ensure they hold enough capital, and strengthen the stability of the financial system.

The IFABS conference was jointly organised by the School of Economics at Shanghai University, the Shanghai Sci-Tech Finance Institute, Saïd Business School at the University of Oxford, Nottingham University Business School, and the European Central Bank.